To read the periodic house price reports out of California, it would be easy to form the impression that house prices are continuing to decline. Most press reports highlight the fact that house prices are lower this year than they were at the same time last year. This masks the reality of robust house price increases that have been underway for nearly half a year. The state may have forfeited seven years of artificially induced house price escalation in just two years but has recovered about one-fifth of it since March. read more »

Middle Class

Boomer Economy Stunting Growth in Northern California

The road north across the Golden Gate leads to some of the prettiest counties in North America. Yet behind the lovely rolling hills, wineries, ranches and picturesque once-rural towns lies a demographic time bomb that neither political party is ready to address.

Paradise is having a problem with the evolving economy. A generational conflict is brewing, pitting the interests and predilections of well-heeled boomers against a growing, predominately Latino working class. And neither the emerging "progressive" politics nor laissez-faire conservatism is offering much in the way of a solution. read more »

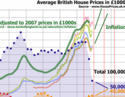

Predicting the Future of British House Building

People are expecting British house building to pick up. Sadly they will be disappointed, even as the housing market inflates into another bubble.

There have been declines and recoveries in British house building before the 2007 collapse in construction activity. Data is in abundance. The total number of homes built annually has more than halved since the late 1960s, as successive governments withdrew from publicly funding the post-war welfare programme of council house building. read more »

- Login to post comments

Honest Services From Bankers? Increasingly Not Likely

Once you understand what financial services are, you’ll quickly come to realize that American consumers are not getting the honest services that they have come to expect from banks. A bank is a business. They offer financial services for profit. Their primary function is to keep money for individual people or companies and to make loans. Banks – and all the Wall Street firms are banks now – play an important role in the virtuous circle of savings and investment. When households have excess earnings – more money than they need for their expenses – they can make savings deposits at banks. Banks channel savings from households to entrepreneurs and businesses in the form of loans. Entrepreneurs can use the loans to create new businesses which will employee more labor, thus increasing the earnings that households have available to more savings deposits – which brings the process fully around the virtuous circle. read more »

- Login to post comments

Obama Still Can Save His Presidency

A good friend of mine, a Democratic mayor here in California, describes the Obama administration as "Moveon.org run by the Chicago machine." This combination may have been good enough to beat John McCain in 2008, but it is proving a damned poor way to run a country or build a strong, effective political majority. And while the president's charismatic talent – and the lack of such among his opposition – may keep him in office, it will be largely as a kind of permanent lame duck unable to make any of the transformative changes he promised as a candidate. read more »

Congress and the Administration Take Aim at Local Democracy

Local democracy has been a mainstay of the US political system. This is evident from the town hall governments in New England to the small towns that the majority of Americans choose to live in today.

In most states and metropolitan areas, substantial policy issues – such as zoning and land use decisions – are largely under the control of those who have a principal interest: local voters who actually live in the nation’s cities, towns, villages, townships and unincorporated county areas. This may be about to change. read more »

Go to Middle America, Young Men & Women

A few weeks ago, Eamon Moynihan reviewed economic research on cost of living by state in a newgeography.com article. The results may seem surprising, given that some of the states with the highest median incomes rated far lower once prices were taken into consideration. The dynamic extends to the nation’s 51 metropolitan areas with more than 1,000,000 population (See Table). read more »

There’s No Place Like Home, Americans are Returning to Localism

On almost any night of the week, Churchill's Restaurant is hopping. The 10-year-old hot spot in Rockville Centre, Long Island, is packed with locals drinking beer and eating burgers, with some customers spilling over onto the street. "We have lots of regulars—people who are recognized when they come in," says co-owner Kevin Culhane. In fact, regulars make up more than 80 percent of the restaurant's customers. "People feel comfortable and safe here," Culhane says. "This is their place." read more »

Can Silicon Valley Attract the Right Workforce for its Next Turnaround?

In less than 30 years, Silicon Valley has rocketed to celebrity status. The region serves as the top magnet for innovation, often occupying the coveted #1 position of global hot spot rankings. More of an informal shared experience than a physical place, Silicon Valley capitalizes on being centrally located in the San Francisco Bay Area, a broader regional zone that is an economic powerhouse. read more »

Crash in High-end Real Estate or a Roller Coaster Recession? :

During the first ten days of October 2008, the Dow Jones dropped 2,399.47 points, losing trillions of investor equity. The Federal Government pushed TARP, a $700 billion bail-out, through Congress to rescue the beleaguered financial institutions. The collapse of the financial system was likened to an earthquake. In reality, what happened was more like a shift of tectonic plates.

******************************************* read more »