A long-term trend which is continuing, is that the US is running ahead of Europe in terms of prosperity. In 2024, the US economy grew by 2.8 percent, according to the World Economic Outlook, compared to merely 0.8 in the Euro area. In 2025 the gap will reduce somewhat, but the US is still expected to grow its economy by a percentage point more than the Euro area. In 2029, the US economy is still expected to grow at 2.1 percent compared to 1.2 percent in the Euro nations.

One way of looking at it is that we live in a time of continued urbanization and population demise, trends which are apparent throughout the world – yet the US is faring better than Europe in terms of demographics. A global comparison suggests that a key reason is the difference in the tax burden, with the US growing more thanks to a lower burden.

Taxes affect the decision of talents, entrepreneurs, companies and investors. Particularly high skilled people tend to prefer low tax jurisdiction. Demographic challenges exist in low tax as well as in high tax countries, but the challenge of prosperity growth is far more difficult for high tax nations to tackle.

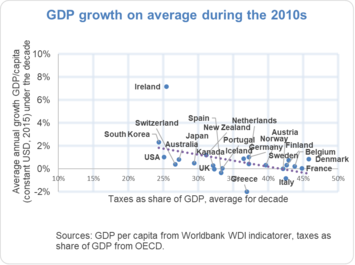

Indeed, it was the global pattern during the 2010s, that advanced countries with lower tax burdens had more economic progress. Ireland had for example an average of 7.2 percent annual growth during this period, thanks to low taxes and business friendly regulations attracting foreign firms and boosting local business growth. Many high tax European economies have however during this period, had limited or even negative growth of GDP per capita.

It is relevant to know that the global pattern shown for the 2010s is not unique. During the 2000s, the 1990s, the 1980s and the 1970s advanced countries with lower tax burdens had more economic growth on average. By adopting free markets and low taxes, countries such as South Korea and Ireland, have been able to increase prosperity significantly during the last five decades.

The comparison of brain business jobs – a term for the share of the working-age population across Europe employed in highly knowledge-intensive enterprises – shows how the knowledge geography is shifting within Europe.

Ireland, Netherlands and Malta with business-friendly policies and taxation are fast climbers in terms of the knowledge intensive jobs of Europe. These countries thrive in brain business jobs growth since they have competitive taxation costs for investors, businesses and labor. They are also progressing in human capital, with Ireland and Estonia having amongst the best school results in the world, according to PISA. The Netherlands, which has a moderate taxation level and business friendly policies, also is amongst the climbers.

The link between economic progress and tax rate has existed for the last five decades, and according to observations by leading economist such as Ibn Khaldun and Arthur Laffer, is a common theme in human civilization. An important point is that high tax and big government policies during a time of population growth can crowd out growth, but still be somehow manageable since the underlying growth levels are high. Now that we live in a time of demographic decline and continued rapid urbanization, the importance of boosting progress becomes even more important.

To avoid stagnation in coming decades, it is wise to focus on limiting the burden of taxation and the crowding out effect of large interventionist governments. High taxes are what holds Europe back compared to the US.

Yet, this is not a feature of Europe as a whole, just the big lumbering economies with too much bureaucracy and state intervention in the economy. EU nations with low taxes that create incentives to work, and growing human talent pools, are estimated to even outpace the US in long terms growth.

In 2029, according to the World Economic Outlook, the US growth of 2.1 percent would be still significantly higher than 1.2 percent in the EU area. But the US would be outpaced by many individual EU nations. This includes Ireland, Luxembourg and Slovakia (2.3 percent), Slovenia and Latvia (2.5 percent), Croatia (2.6 percent), Cyprus (3 percent) and Malta (3.5 percent).

Of course, these are just estimates of the future to come, but the conclusion is still relevant. If the large European economies are tired of stagnating, they need to shift course in economic policy. Why not learn from those EU nations with smaller government sectors and less taxations, which prosper by allowing private enterprise to thrive.

Nima Sanandaji, Director, European Centre for Entrepreneurship and Policy Reform (ECEPR)

Chart: courtesy the author.