Recently published research by Brian N. Jansen and Edwin S. Mills represents notable addition to the already rich academic literature that associates more stringent land use regulation with higher house prices. The analysis is unusually comprehensive and its conclusions indicate greater consequences than is usually cited. Mills is Professor Emeritus of Real Estate and Finance at Northwestern University and is renowned for his contributions to urban economics over more than five decades.

The Research

The comprehensiveness of the research is indicated by the fact that it covers all of the 268 metropolitan areas in the United States for which complete data was available. The focus was on the trend of house prices leading up to 2006, the peak of the housing bubble. Their econometric analysis showed that "stringent land use controls raise house prices."

They also found that more stringent land use controls were associated with greater house price losses following the peak.

“The strong conclusion of this paper is that stringent residential land use controls were a primary cause of the massive house price inflation from about 1992 two 2006 and possibly of the deflation that started in 2007.”

Overall, this finding is consistent with the work of others (such as in Glaeser and Gyourko) who have associated more stringent land use controls with greater house price instability.

Consistency with Economic Principle & Previous Research

The Jansen and Mills findings reiterate those of a large body of research. Economists Richard Green and Stephen Malpezzi summarized the issue a decade ago:

“When the supply of any commodity is restricted, the commodity's price rises. To the extent that land – use, building codes, housing finance, or any other type of regulation is binding, it will worsen housing affordability.”

This relationship is even acknowledged by proponents of more stringent land use policies. A Brookings Institution team led by University of Utah Professor Arthur C. Nelson indicated that “If … policies serve to restrict land supplies, then housing price increases are expected.”

Needless to say, any other effect would be the equivalent of “sun rising in the West” economics.”

The more stringent land use regulations include blunt tools like the urban growth boundaries of Vancouver, Sydney, Portland or the San Francisco Bay Area but also the large-lot suburban lots that have rendered Boston's urban densities nearly as low as Atlanta. Artificial limits on development lead to higher house prices, other things being equal.

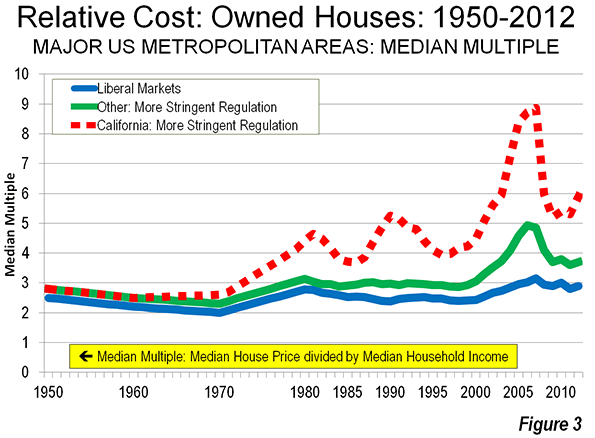

This will come as no surprise to those familiar with the work of Dartmouth economist William Fischel who attributed California’s high house prices to stringent land use regulation. He noted that until around 1970, California house prices had been nearly the same, relative to incomes as the rest of the nation, before more stringent land use regulation began. Now house prices in coastal California markets are double those in liberally regulated markets, measured by the median multiple (median house price divided by median household income).

Unintended Consequences: Portland and California

The Jansen and Mills findings will disappoint urban containment (smart growth or growth management) advocates who have often denied the economic reality of its influence on house prices. Some had hoped that the house price increasing effects of stringent land use regulation would be neutralized by more affordable housing costs in the cores of metropolitan areas, where more dense housing would be permitted. A principle source of this view is an analysis of early 1990s Portland (Oregon) house prices by Justin Phillips and Eban Goodstein, who said that such an effect “should” occur.

Yet in the 15 years since the period covered by this research, Portland house prices have risen with a vengeance (see The Evolving Urban Form: Portland), with the median multiple rising more than 40 percent, from 3.0 in 1995 to 4.3 in 2012. Obviously, with such an increase, the price increasing impacts of Portland's urban growth boundary have not been negated.

Further, housing costs rose in Portland's densifying areas at virtually the same rate as in the rest of the metropolitan area over the period from 1999 to 2009. Census and American Community Survey data indicates that densifying zip code areas (housing unit density increases of 5 percent or more) experienced median multiple increases of 37 percent, compared to 36 percent for the balance of the metropolitan area (Note). Rents in the densifying areas rose 9 percent, compared to 8 percent in the rest of the area.

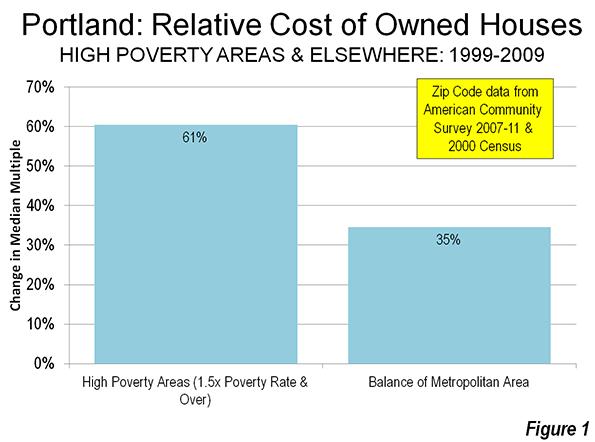

The impact on Portland's low income population, however, was less than equitable. The cost of owned housing rose 75 percent more in areas of higher poverty (areas with poverty rates 50 percent or more than the average rate) than in the balance of the metropolitan area. The median multiple (value) rose 61 percent in the high poverty areas and only 35 percent elsewhere (Figure 1).

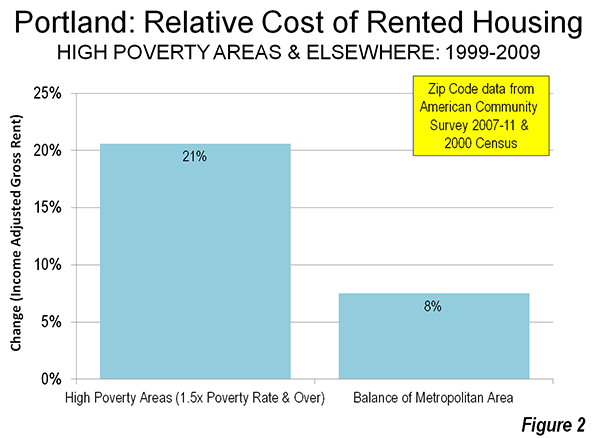

The difference was even starker in rentals, where low income households are concentrated. Income adjusted median gross rents in the high poverty areas rose more than 2.5 times the increase in the rest of the metropolitan area. In the high poverty areas, the increase was 21 percent and only 8 percent elsewhere (Figure 2).

The housing cost increases in the higher poverty areas appears to be at least partially from gentrification as well as Portland’s efforts to improve neighborhoods through urban renewal. In assessing the results of the 2010 census, The Oregonian noted that the core city of Portland had become less diverse and that many African-American households were driven out of their neighborhoods by “gentrification.”

This greater housing cost burden on lower income households belies the noble intentions expressed in much of the urban containment and smart growth literature. Results are more important than intentions.

Portland is not alone. Nelson, et al, were uncritical of Portland a decade ago (before the evidence of house price increases was so clear), but did not mince words in characterizing the already evident higher prices from stringent land use policies in California, saying: “This is arguably what happened in parts of California where growth boundaries were drawn so tightly without accommodating other housing needs that housing supply fell relative to demand.”

The Broader Consequences of Stringent Land Use Regulation

Jansen and Mills took the research farther than most others. In their econometrics, they found more stringent land use regulation negatively impacted metropolitan area population, employment and per capita real income.

They also considered the role of stringent land use controls in the Great Financial Crisis. This issue had also been a subject of inquiry of the congressionally established United States Financial Crisis Inquiry Commission, which documented much larger than national housing bubbles in the so-called “sand states” of California, Florida, Arizona and Nevada. Three of the

10 members issued a minority opinion citing land use controls as one of the causes of the housing bubble (which is widely considered to have sparked the Great Financial Crisis). The major metropolitan areas in the “sand states” all had strong land use restrictions.

“Land use restrictions. In some areas, local zoning rules and other land use restrictions, as well as natural barriers to building, made it hard to build new houses to meet increased demand resulting from population growth. When supply is constrained and demand increases, prices go up.”

My analysis of metropolitan markets for the National Center for Policy Analysis suggested a similar relationship (see The Housing Crash and Smart Growth).

Jansen and Mills squarely place blame for the Great Financial Crisis on stringent land use controls.

“Indeed, it is difficult to imagine another plausible cause of the 2008–2009 financial crisis. Popular accounts simply refer to a speculative housing price bubble. But productivity growth in housing construction is faster than in the economy as a whole and the US has an aggressive and competitive housing construction sector. In the absence of excessive controls, housing construction would quickly deflate a speculative housing price bubble.”

The absence of excessive controls would have defused the housing bubble, they suggested. This notion is supported by the experience of metropolitan areas with liberal land use regulation (Figure 3) where median multiple remained near or below 3.0 in liberally regulated markets. This standard has typified affordable markets since World War II, as well as California markets to the early 1970s and Portland until 1995. The retention of housing affordability is especially significant in Atlanta, Dallas-Fort Worth and Houston, which experienced some of the largest rates of domestic in-migration during the bubble. This is in contrast to the more stringently regulated high cost markets of coastal California, which experienced huge out-migration during the same period.

The Imperative for Job Creation and Economic Growth

All of this is particularly important because housing is the most expensive element of household budgets, and unlike transportation and most consumer goods, is extremely sensitive to varying local and regional public policies. Where households have to pay more for housing, they have less discretionary income and necessarily have a lower standard of living. This is deleterious to virtually all households and is especially burdensome on lower income households.

Many young adults are “doubling up” with their parents, deferring their own independence, facing huge student loan debts and inadequate employment prospects in what may become the Great Malaise. Taxpayers in many jurisdictions face unprecedented burdens in funding unsustainable government employee pension benefits. Only job creation and economic growth can solve these problems. The last thing the economy needs is stringent land use policies that reduce employment, economic growth and per capita real incomes.

Wendell Cox is a Visiting Professor, Conservatoire National des Arts et Metiers, Paris and the author of “War on the Dream: How Anti-Sprawl Policy Threatens the Quality of Life.

-----

Note: Median multiple data from the Census Bureau (and the American Community Survey) are reported using median house values, instead of the more common median house price.

-----

Photo: 1,700 square foot house in exurban Los Angeles priced at $575,000 at the peak of the housing bubble (by author).

CORRECTION

Land use regulation as a cause of the housing bubble should have been should have been attributed to a dissenting opinion in the United States Financial Crisis Inquiry Commission, rather to the Commission itself.

After watching those graphs

After watching those graphs I don't it would be really possible to control the rise in the prizes of lands, irrespective of whether its of rural or urban areas.

http://www.kevinbradleyrealtor.com/

When Cox's Mouth Moves...

...you can be sure you won't be getting the "straight dope."

The very first sentences of the study cited by Cox talks about DOWNZONING:

"Residential land use controls are mostly intended to and do limit housing densities. Restrictions to single family detached houses, minimum lot sizes, height limitations, floor/area ratio limits and restrictions on numbers of buildings per lot are examples."

And the first sentences of their conclusions:

"Our estimates of our simple four simultaneous equation model imply that, at least in 2006, stringent density controls in an MSA raised housing prices and lowered real incomes, employment and population.

The strong conclusion of this paper is that stringent residential land use controls were a primary cause of the massive house price inflation from about 1992 to 2006 and possibly of the deflation that started in 2007."

Obviously urban limit lines may play some role in housing price increases, but DOWNZONING has a lot more to do with high housing prices--as well as limited, desirable locations such as at or near the seashore--than Cox seems willing to admit. The paper cited by Cox in this article simply reinforces the points made by Jonathan Levine in his 2006 book Zoned Out.

And "New Urbanism" "Smart Growth" "Agenda 21" or whatever else you care to call efforts at re-urbanization have virtually nothing to do with downzoning.

It is this sort of misleading "analysis" by Cox that leads many people, including myself, to consider him to be a charlatan.

Density mandates are peripheral, fringe constraints are central

Actually, Cox is ahead of those other people. He is not a charlatan, he is an under-appreciated guru.

There are plenty of cities with low density mandates that are still affordable and with stable housing prices.

The low density mandates make only marginal differences to housing affordability.

The sole significant factor is the ability to develop non-urban land without exponential levels of "planning gain" being captured by site vendors.

When you can develop land you bought for $4,000 per acre, it hardly matters whether you mandate low density. The contribution of raw land cost to housing cost is minimal.

However, everywhere there is "regional planning" and UGB's and containment zoning and so on, developers will be having to pay hundreds of times as much per acre to secure sites in the first place. And when the raw land price is hundreds of thousands of dollars per acre, density mandates DO really matter. But there is no example in the world of cities with fringe growth constraints and affordable, stable-price housing regardless of how high their densities go to attempt to compensate for the higher land costs.

Four Causes of the Great Financial Crisis

Your statement that the United States Financial Crisis Inquiry Commission hypothesized stringent land use controls as one of four causes of the Great Financial Crisis is wrong.

Three dissenting members of the Commission hypothesized that stringent land use controls were one of four (maybe) causes of the housing bubble, not the Financial Crisis. As they write "we still don’t know the relative importance of the possible causes of the housing bubble."

Furthermore, the housing bubble is one of the ten essential causes of the financial and economic crisis. There were many other pieces at play.

The committee concluded that credit agencies, over-the-counter derivatives, terrible mortgage-lending standards, and risky behaviour by financial institutions was the cause. At no point does majority opinion of the committee conclude that land use controls contributed to the crisis.

Cox et al are Copernicus and Galileo

The mainstream is hopeless on this. Cox and others like him are the Copernicuses and Galileos of economics. The "smart growthers" are the establishment theocracy.

If the whole of the USA had housing markets like the 150 odd heartland and southern cities that had no price bubble, there would have been no crisis at all.

There would still have been a crisis in other countries because of smart-growth-caused house price volatility there.

South Korea is an example of a nation with very strict monetary and mortgage credit conditions that has still had housing market price volatility.

There are very few such examples simply because politicians everywhere LOVE loosening credit and forcing mortgage lenders to lend more, every time there is a housing affordability crisis. Look at the UK right now. Insane.

The underlying cause never gets addressed - a rationed supply of land for urban property markets, causing continual rises in economic land rent. The UK's urban economic land rent is now around 300 times higher than what it is in affordable US cities - and it has had what has been acknowledged as some of the soundest monetary management for decades. It has, however, had "smart growth" - by a different name - for decades too.

Inflation does not happen only where the planners want it

".....housing costs rose in Portland's densifying areas at virtually the same rate as in the rest of the metropolitan area over the period from 1999 to 2009....."

That is another thing the planners and politicians need to understand. The unintended consequence is that LESS people can afford the prices in the more central areas, than before. "Drive to qualify" becomes a stronger and stronger effect the higher the prices "everywhere" go.

The NZ Productivity Commission's 2012 Report on Housing Affordability included an urban land rent curve analysis for Auckland over a period of years that showed the same thing there as in Portland; the inflation was even across the entire spatial range from fringe to centre.

The planners probably hope to make fringe McMansions unaffordable and CBD condos more affordable. Well, they are learning some lessons about the invisible hand, that differs from the lessons learned in the former Communist economies, only in scale of monstrosity.

Grammar Nazi Alert

fewer people

not less people

Disparate Impact

".....The impact on Portland's low income population, however, was less than equitable. The cost of owned housing rose 75 percent more in areas of higher poverty (areas with poverty rates 50 percent or more than the average rate) than in the balance of the metropolitan area. The median multiple (value) rose 61 percent in the high poverty areas and only 35 percent elsewhere...."

This cannot be emphasised more. Bassett and Malpass, just released, say that in Auckland NZ, the price inflation has been 260% in the bottom quartile of the housing market and 150% in the top quartile.

It is obvious from a look at RE sites in unaffordable cities versus affordable, that the cheapest possible house is far more expensive in the former than the relative median multiples would suggest. It is easy to find comparable dilapidated small homes in Auckland and Sydney and Vancouver and Manchester UK that are around $600,000, and the same thing in any city in Texas for under $100,000.

Perhaps we need some "bottom quartile multiples" to illustrate to the politicians and planners, just how "disparate" the impact is?