NewGeography.com blogs

The battle to find ways to close California's gaping $24 billion budget shortfall continues, with Governor Schwarzenegger calling for deep cuts and reorganization throughout state government. Last week, making a "rare speech to a joint session of the Legislature," Gov. Schwarzenegger argued that the state has "run out of time," and faces a situation where "Our wallet is empty, our bank is closed, and our credit is dried up".

The challenges facing California's policy makers in balancing the budget can be examined by checking out the Los Angeles Times' "Interactive California Budget Balancer". While the state has many different options available to it, making cuts to potentially popular programs will only serve to irritate interest groups which argue for the efficacy and essential nature of their favored programs. Couple this reluctance to make cuts with popular resistance to tax increases, recently seen when voters rejected a set of measures on May 19, and one can better understand the true magnitude of the budget impasse facing the state.

“A new business model” is what Jack Nerad of Kelly Blue Book called the proposed sale of Saturn by General Motors (GM) to Roger Penske’s Penske Automotive Group.

What makes it a new model is that Penske would only buy the brand and the dealer network. Penske would subcontract vehicle production other manufacturers, though for the first two years, the GM Saturn plant would produce the cars. Doubtless, Penske will buy vehicles from assembly plants able to provide the best quality for the dollar, establishing competition at the factory rather than corporate level. This radical departure solves the fundamental problem leading to the near-death of the American automobile industry.

Following World War II, America had little competition. Industrial powers such as in Europe and Japan were flat on their backs and American manufacturers had a “clear field.” American labor and management bid up the price of heavy manufactured goods so much that they became less competitive when war torn economies recovered.

Americans paid over and over again in their automotive purchases. They paid first through reliability difficulties that were the inevitable result of attempting to compete on price with foreign firms with costs that were competitive in world markets. Finally, they paid with more than $60 billion in loans to General Motors, GMAC and Chrysler. Canadians also paid twice, most recently in more than $13 billion in loans that make their per capita contribution substantially higher than that of Americans. It is not at all clear that North American taxpayers will ever see these amounts repaid (American taxpayers are still waiting for the first penny of repayment from Amtrak on loans made more than 25 years ago).

The recent loans were the result of a political consensus that GM and Chrysler were “too big to fail.” In an industry characterized by the Penske-Saturn model, the too-big-to-fail problem would be removed.

There was terrible news for Dayton this week as the city's last Fortune 500 company, NCR, founded locally in 1884, announced it was moving its headquarters to Atlanta. The Dayton Daily News is the place for complete coverage.

This is bad news not just for Dayton, but for the state of Ohio and the entire Midwest. Firstly, it illustrates the plight of the smaller cities of the Midwest, the ones below one million in metro area population that I usually don't write much about. These cities, including places like Dayton, Youngstown, and Toledo, are often struggling. Unless they are a state capital and/or home to a major state university, they just don't seem to have quite the scale necessary to operate in the globalized economy. These cities have special challenges and I won't profess to have answers for them.

Secondly, this is further damage to the economic reputation of the Midwest as a whole. Loyal readers know that I've been skeptical of cross-regional collaboration as a panacea (though I've also written some positive things about it). However, there are clearly issues that affect the Midwest as a whole. It has, for example, a collective reputation as the Rust Belt that probably only Chicago is able to overcome.

This reputation creates formidable brand headwinds in trying to attract the talent needed to compete in the 21st century. The Atlanta Business Chronicle had an interesting take on the NCR move, with one anonymous source attributing it to talent issues with Dayton. "They [NCR] can’t recruit talent to move to Dayton, Ohio."

So what, you might say. It's Dayton. But my town is way cooler than Dayton. Well, the problem extends well beyond Dayton. Consider Ann Arbor. If any city in the Midwest can claim to be a winner in a the knowledge economy, it has to be the home of U of M, the best public university in the Midwest. But according to an article in the Journal, "Despite Ann Arbor's educated work force, employers here find Michigan's reputation as a failing manufacturing economy can deter potential hires from moving to the state."

In short, this thing affects everybody. Even the best regional performers will be fighting horrible brand headwinds as long as the region in which they are embedded continues to fail. It's like a larger version of what I've long said about the Hoosier State, that there can't be a long term prosperous Indianapolis without a prosperous Indiana.

The lessons of Dayton and NCR are not being lost on people locally and around the state at least. Local blog Dayton Most Metro asks, "Are we ready to wake up yet?"

And a columnist in the Cleveland Plain Dealer chimes in with a call to arms for his city.

When Ohio cities lose storied corporate birthrights to the likes of Beijing, Calcutta, or even the green fields of Ohio suburbia, I understand potentially insurmountable market forces at work.

But when we continue to lose to the likes of Georgia, I only recognize underperforming leadership and a criminal failure to anticipate market realities.

In trying to understand the meaning of it all, we should reflect on the somber and lonely sentiments of a Dayton Daily News editorial that noted Wednesday that the city is now on its own.

Closer to home, Cuyahoga County continues to inch closer to its civic funeral. Not only do we continue to bleed off population and shutter what is left of our industrial base, we continue to act in a predictable political fashion that hastens our day of reckoning.

The inability of Cuyahoga County officials to agree on government reform tells the world that Northeast Ohio continues to be no place to do business. Like Dayton, our region remains a corporate cherry-picker's fantasy.

Soon there will be nothing left to govern in Cuyahoga County.

This post originally appeared at The Urbanophile.

Would you like to avoid recessions altogether?

You can come close if you live in the right place.

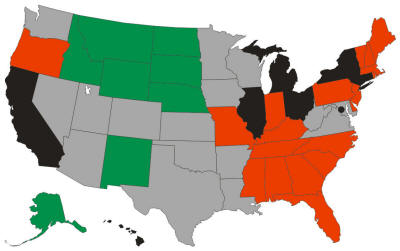

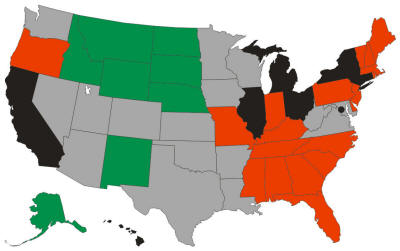

This report looks at the period January 1991 through April 2009 – a period of 220 months that includes three recessions. Since employment rises and falls monthly because of seasonal trends (school year, holiday retail and more), this report uses 12-month employment growth rates as the measurement criteria – the employment in a given month compared to the employment 12 months earlier. This eliminates seasonality and allows us to compare, if you will, apples with apples.

The metric in this analysis is the percent of months where the 12-month employment growth rate is positive.

Using employment growth rates as the measurement criteria: Using employment growth rates as the measurement criteria:

Alaska is 99.1% recession-proof since employment was growing for 218 months out of 220.

Michigan is 51.8% recession-proof since employment was growing for 114 months out of 220.

All the states are shown in the graphic, color-coded as follows:

- Green is 90% or more

- Grey is 80% to 90%

- Red is 70% to 80%

- Black is less than 70%

Some metropolitan areas are also relatively recession-proof:

| Area |

Share of months where 12-month job growth rate is positive

|

| Grand Junction, CO |

100.00%

|

| McAllen-Edinburg-Mission, TX |

99.50%

|

| Olympia, WA |

99.10%

|

| Bismarck, ND |

98.60%

|

| Anchorage, AK |

97.70%

|

| Fargo, ND-MN |

97.70%

|

| Tyler, TX |

97.30%

|

| Greeley, CO |

96.80%

|

| Iowa City, IA |

96.40%

|

| Sioux Falls, SD |

96.40%

|

| Cheyenne, WY |

95.90%

|

| Columbia, MO |

95.90%

|

| Coeur d'Alene, ID |

95.50%

|

| College Station-Bryan, TX |

95.50%

|

| Billings, MT |

95.00%

|

| Fayetteville-Springdale-Rogers, AR-MO |

94.50%

|

| Laredo, TX |

94.50%

|

| Las Cruces, NM |

94.50%

|

| Valdosta, GA |

94.50%

|

| Killeen-Temple-Fort Hood, TX |

94.10%

|

| Rapid City, SD |

94.10%

|

| Bellingham, WA |

93.60%

|

| Ogden-Clearfield, UT |

93.60%

|

| Knoxville, TN |

93.20%

|

| St. George, UT |

93.20%

|

And, unfortunately, some metropolitan areas are not very recession proof:

| Area |

Share of months where 12-month job growth rate is positive

|

| Baltimore City, MD |

17.70%

|

| Flint, MI |

28.60%

|

| Detroit-Livonia-Dearborn, MI Metro |

34.10%

|

| Philadelphia City, PA |

35.50%

|

| Dayton, OH |

37.30%

|

| Mansfield, OH |

38.20%

|

| Youngstown-Warren-Boardman, OH-PA |

41.80%

|

| Muncie, IN |

42.70%

|

| Kingston, NY |

43.60%

|

| Waterbury, CT NECTA |

45.50%

|

| Binghamton, NY |

47.30%

|

| Lima, OH |

47.30%

|

| Springfield, OH |

48.20%

|

| Detroit-Warren-Livonia, MI |

49.10%

|

| Lansing-East Lansing, MI |

50.00%

|

| Saginaw-Saginaw Township North, MI |

50.50%

|

| Ann Arbor, MI |

51.40%

|

| Cleveland-Elyria-Mentor, OH |

52.70%

|

| Decatur, IL |

52.70%

|

| Terre Haute, IN |

53.60%

|

| Canton-Massillon, OH |

54.10%

|

| Battle Creek, MI |

54.50%

|

| Jackson, MI |

55.00%

|

| Niles-Benton Harbor, MI |

55.00%

|

You can’t necessarily judge a metropolitan area by its State’s employment growth rates. For example, Georgia is only 73.6% recession-proof yet Valdosta is 94.5%. Indiana is 74.5% yet Indianapolis is 90.0%. Missouri is 72.3% yet Columbia is 95.9%.

A complete list of states and metropolitan areas is available at http://jobbait.com/a/rpa.htm.

The data in this report present only part of a recession-proof picture of states and metropolitan areas. Think of them as a long-term picture from 1990 through April 2009. They do not necessarily represent what’s happening today. For example, Olympia WA which is the second-most recession-proof metropolitan area long term has declines in the last two months, March and April 2009. And, this will change next month and the month after.

This report was written by Mark Hovind, President of JobBait. Mark helps six and seven figure executives find jobs by going directly to the decision-makers most likely to hire them. Mark can be reached through www.JobBait.com or by email at Mark@JobBait.com.

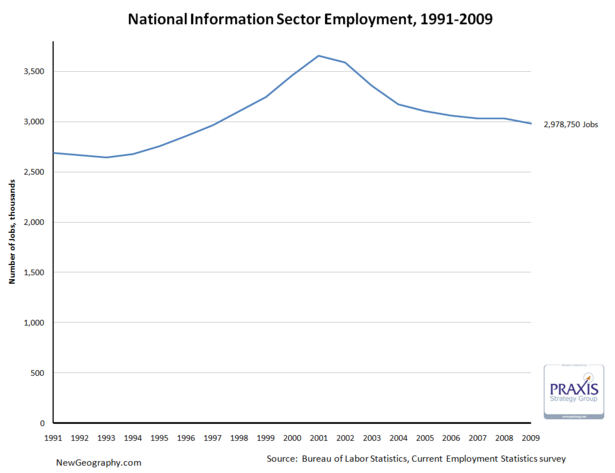

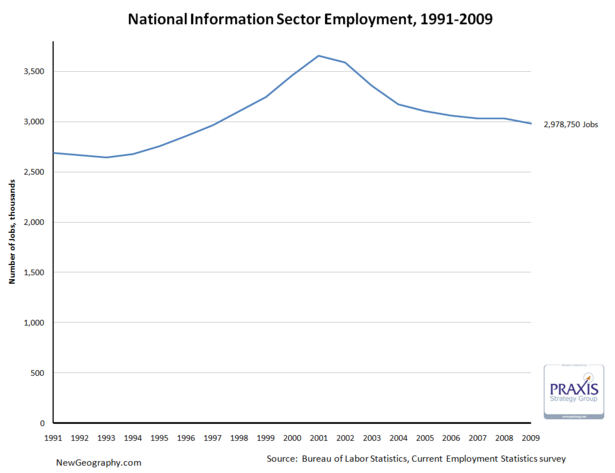

Between economic development strategies targeting software firms, the deflation of the tech bubble, talk of "broadband," and recent consternation about failing publishing business models, we seem to hear a lot about the information sector. Recognizing that, it's interesting that the information sector only comprises about 2.2% of total employment in the US.

On top of that, after a big decline since the tech bubble peak in 2001, in February the sector has receded to just more than 2.9 million jobs, a level not seen since April 1996.

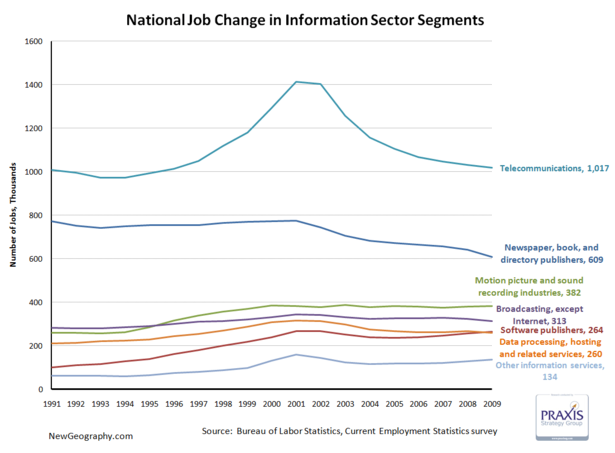

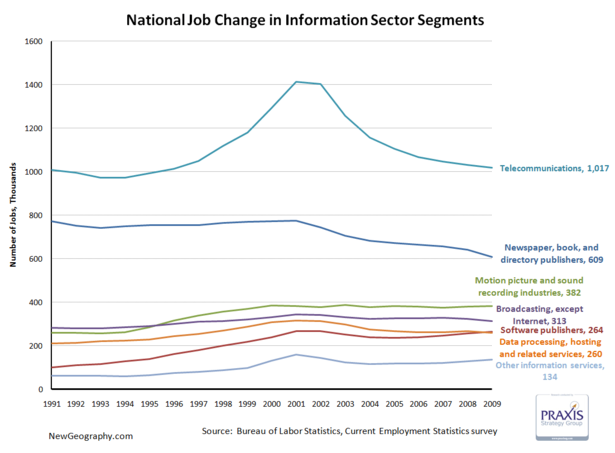

The telecommunications subsector accounts for just more than 1/3 of information employment, and saw the biggest boom and bust. Publishing has declined since 2000, and motion picture and sound recording industries are larger than either software publishing or data processing.

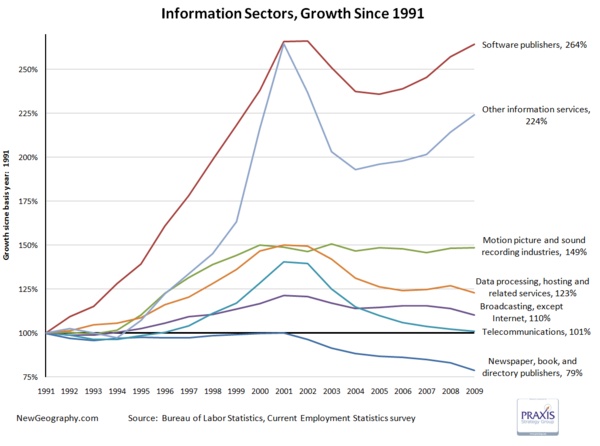

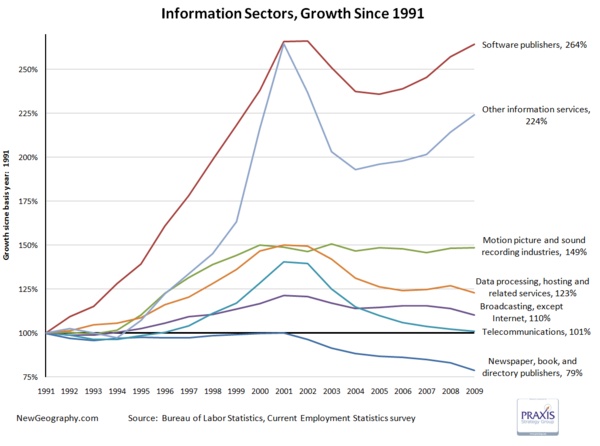

Looking at percent change, software has recovered from the tech bust, while the movie business has remained steady since topping off in 2000. Worse off are telecom and data processing, which continue the post bust slide.

One fifth of the jobs in the publishing industry have vanished since 2001.

This is not to say technology occupations are not a key part of the nation's economy and productivity gains over the past decade, but the importance of the information sector itself is overstated. High-tech industries that produce products generally fall into manufacturing sectors while things like systems design, web design, or even custom programming are business services.

The next post will look at regional shifts in information employment, but until then check out Ross Devol's more comprehensive study on regional tech poles.

Other Information services includes: news syndicates, libraries, archives, exclusive Internet publishing and/or broadcasting, and Web Search Portals.

|

Using employment growth rates as the measurement criteria:

Using employment growth rates as the measurement criteria: