NewGeography.com blogs

An article in The Wall Street Journal details the difficulties that were faced by home owners caught in the Goldman Sachs/John Paulson finance scheme ("The Busted Homes Behind a Big Bet"). The article calls the situation a "dizzyingly complex transaction, involving 90 bonds and a 65-page deal sheet. But it all boiled down to whether people ... could pay their mortgages." There is plenty of blame to go around, but surely there were both big winners and big losers is these deals. The big winners were Goldman Sachs and John Paulson. The big losers were the homeowners, though they were not without blame, since they were not forced to take out the excessively large mortgages.

The striking thing about this story, however, is the photograph of a Levittown style house in Aberdeen township, New Jersey, a distant suburb nearly 40 miles from New York City. The picture in the article cannot be directly linked, and the best view is on an interactive slide show linked to the article. We have provided a photograph of a near somewhat smaller house in Levittown (see photo).

In 2006, the owner had refinanced the house with a $308,750 loan, indicating a value more than triple that of comparable housing in much of metropolitan America. In 2006, the owner had refinanced the house with a $308,750 loan, indicating a value more than triple that of comparable housing in much of metropolitan America.

Levittown, of course, was the late 1940s housing development on Long Island that set the stage for the automobile oriented suburban expansion that did so much to create the largest and most affluent middle class in the world. The Levittown houses were very small, starting at about 750 square feet, though many have been expanded. It was not long before suburban housing became larger, eventually rising to the present 2,250 square foot median. The Wall Street Journal's Aberdeen township house is under 1,500 square feet, according to Zillow and was built in 1953.

The Wall Street Journal article misses a significant point. How could such a modest (and doubtless comfortable) house have become so valuable that it could justify refinancing for more than $300,000? The answer is simple. During the real estate bubble, house prices in New Jersey exploded. The state's restrictive land use regulation largely prohibit new housing on the suburban fringe, leaving prices nowhere to go but up and up strongly. Between 2000 and 2006, the median house value in Monmouth County, where Aberdeen Township is located, rose 125% (according to US Bureau of the Census data). 2006 data for Aberdeen township is not readily available.

By the peak of the bubble, the median value house in Monmouth County was 5.8 times the median household income, up from 3.0 times in 2000. In 2000, prices were even lower in Aberdeen township, at 2.3 times incomes – well within the 3.0 standard that defined housing affordability for at least one-half century.

While owners were borrowing $300,000 or more on their modest early 1950s houses in Aberdeen township, households were buying brand new houses of the same size for under $120,000 in Dallas-Fort Worth, Atlanta, Houston, Indianapolis and a host of other metropolitan areas where the American Dream had not been outlawed. Expansion of the housing supply was allowed, and prices stayed within historic norms. For example, in Indianapolis, house prices were less than one-half that of Monmouth County, after adjusting for income levels.

Meanwhile, a judgment of $370,000 has been entered against the owner of the Aberdeen township Levittowner. The auction in late April by the Monmouth County Sheriff for a price that is probably closer to its real value if it had been in a rationally regulated jurisdiction: $100.

by Anonymous 05/18/2010

I need a stronger dose of Vitamin G. No, not Riboflavin or Vitamin B2 as it is sometimes called, but Vitamin G: the Green Space Vitamin! Everyday there seems to be more data confirming my personal beliefs that being around, in and associated with green space promotes health, well-being and an enhanced social safety network (reducing stress, anger, frustration and aggression) in all of us. There is a strong, positive relationship found between the amount of green space in our living environment and physical and mental health and longevity.

Researchers have been studying this issue for some time and have discovered that us, human beings, are “phytotrophic”- we are attracted to environments that include trees, grass and other natural elements.

Much like a vitamin that you eat, drink or rub on your skin, Vitamin G can be taken in many ways. Research shows the benefit of nature broadens to varying avenues of exposure and beneficial contact with nature need not involve getting one’s hands dirty. Gardening is beneficial, but so is walking, jogging, biking or even canoeing through a natural setting.* Even non-nature focused activities, such as reading or playing basketball, in a relatively green setting is more beneficial than the same activities indoors or in a less green outdoor setting.* Even a simple window view has measurable effects. Also like a vitamin, evidence suggests that contact with nature is needed in frequent and regular doses.

“Vitamin G seems to be beneficial regardless of its physical form. Research shows that the benefits of nature seem to extend to a tremendous variety of stimuli (e.g. large forests, small urban gardens, prairies, nature preserves, vest-pocket parks, mountains, landscapes with water features, an aquarium in an office, tree-lined city streets, shady back yards, and soccer fields).”* Seeing and being in any form of green space benefits us, regardless of its shape, size and texture.

Unfortunately, many policy makers, at least up until now, view green space as a luxury good rather than as a basic necessity, overlooking the important and beneficial effects of green space on our health, well-being and safety. In fact, for those of us tied to our homes a bit more closely (elderly, children, low income adults), defined green spaces are even more important to our health! “The tight integration of natural elements into the urban fabric can now be thought of as preventative medicine – a public health measure designed to reduce physical, social, and psychological breakdown in urban dwellers.”

For many of us that don’t have the opportunity (and that green peace of mind derived from this) of owning a cabin or destination green space, we need better policy, design and implementation to happen within our communities, in order to maximize our exposure to Vitamin G. I know in St. Louis Park, we try to incorporate many green items, for example we have a master sidewalk and trail plan (some of it still needs to be implemented, but it is planned for) that provides opportunities to experience green boulevards, parkways, wooded areas and other green features. We also provide many parks, of varying size, easily experienced by most folks, since all are within a quarter mile of any residence. But there is room for improvement in our attaining our recommended doses of our citywide Vitamin G.

Vitamin G is a critically important vitamin. I hope Vitamin G becomes a daily staple of every community and person’s diet…our health and welfare depends upon it!

Jim Vaughn is the Environmental Coordinator of the City of St. Louis Park, Minnesota. This blog originally appeared in the St. Louis Park Sun-Sailor.

by Anonymous 05/12/2010

Los Angeles has been "gentrified" and made more stable in many of its areas by immigrant settlement, but the phenomenon of Anglo “gentrification” – what used to be "yuppies" or their more contemporary counterparts (original "yuppies" are now in their 50s) upgrading a formerly "bad" neighborhood by pushing up rents and squeezing out existing relatively poor folks – is rarer in Los Angeles than in almost any other American city.

The closest thing to it has occurred in a few "paleo-urbanist" beach communities. ("Paleo-urbanist" means planned to New Urbanist specifications, but nearly a century ago!) And I think the reason for it has to do with the massive projects by the Irvine Company especially in the 60s and 70s. These projects, plus the nearby existence of Newport Beach – already a "watering spot" for the WAS (WASP but including Catholics, this being California) – plus the riots of 1965, plus the perception that the air in the Irvine and Newport region was less polluted at a time when smog was worse than now, led to a massive secessio patriciorum, a secession of the patricians, It was a physical manifestation of Christopher Lasch's The Revolt of the Elites . Corporate headquarters relocated en masse. Second homes near Newport Bay often became first homes. Many of the people that might otherwise be gentrifiers in Los Angeles were removed to the first great Edge City, at the head of Newport Bay. . Corporate headquarters relocated en masse. Second homes near Newport Bay often became first homes. Many of the people that might otherwise be gentrifiers in Los Angeles were removed to the first great Edge City, at the head of Newport Bay.

Los Angeles proper ultimately recovered from the Great Secession. It did so with the help of immigrants on the one hand, and the entertainment industry on the other. In days of old "Hollywood" and "Los Angeles" had been two separate cities occupying the same space. Outsiders who were concerned with the film industry often didn't refer to "LA" at all, but to "Hollywood" or "The Coast." "LA" was the rather bourgeois city that happened to occupy the same physical space.

I remember, for example, when Los Angeles magazine was socially conservative enough to declare, "Why is it they never organize against the popular smut [pornography] – movies like Beach Party, for instance?" This is unimaginable now. I also remember how few were the movie stars in attendance at the openings of the major Music Center (now LA Performing Arts Center) in 1964 and 1967.

It is now recognized that Hollywood is at the center of cultural life in Los Angeles. The two largest political parties in the state are the Hollywood Democrats and the Eastside LA Democrats, with quite different social priorities. The third party, the Republicans, is desperately trying to hold on to its veto on taxation and the budget. As a matter of fact, the terms Westside and Eastside are used a lot more now. When I lived in Hancock Park in my high school years, I had somewhat of a perception that I was in the exact middle. Wilshire Boulevard, the grand prestigious street of Los Angeles, had, because of foolish zoning, a strip of vacant lots where it went by the Hancock Park residential district (not to be confused with the city park of the same name, two miles west, where LACMA and the Page Museum are}. These lots were not built on until the 70s, when condos were allowed there.

The so called "Park Mile" did provide a separation between the Miracle Mile on one side and the Wilshire Center – not in those days Koreatown, and in fact a serious rival to Downtown – but the separation between West and East has grown sharper as the Miracle Mile has faded a bit, and Koreatown is what it is and not a rival of Downtown any more. The perceived border between Westside and Eastside LA seems to run near Vine Street, through Old Hollywood and Hancock Park.

Pasadena and Santa Monica, both singularly uncool places 40 years ago, have become among the coolest parts of the city. Remarkably, Pasadena and nearby areas were the main source of the secessio patriciorum of 40 years ago. The vacuum has been filled in a very interesting way!

In contrast, downtown San Diego feels a lot like downtown Denver, except with palm trees and water. Both of those downtowns fill up on weekends at night with hard-partying young Anglos, not exactly to be seen on Broadway in LA at any hour. If there was a secessio patriciorum in San Diego, it was only to the UCSD area near La Jolla, much closer. If the secessio had gone, say, to Carlsbad, and upper class San Diegans had relocated to Carlsbad and La Costa en masse, downtown San Diego might be the ethnic wonderland Downtown LA now is. Carlsbad may be 30 miles away but the few Carlsbadians I know seem a lot more loyal to San Diego than OCers are to Los Angeles. Who knows?

Howard Ahmanson of Fieldstead and Company, a private management firm, has been interested in these issues for many years.

by Anonymous 05/12/2010

Here’s a simple question for you…which metro areas did prospered the most during the past business cycle? (2000-2008) Were the winners the highly-educated communities that make up the Creative Economy? Or did someone else zoom ahead?

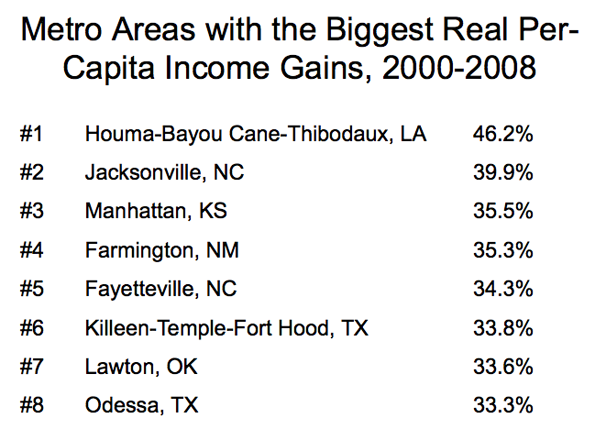

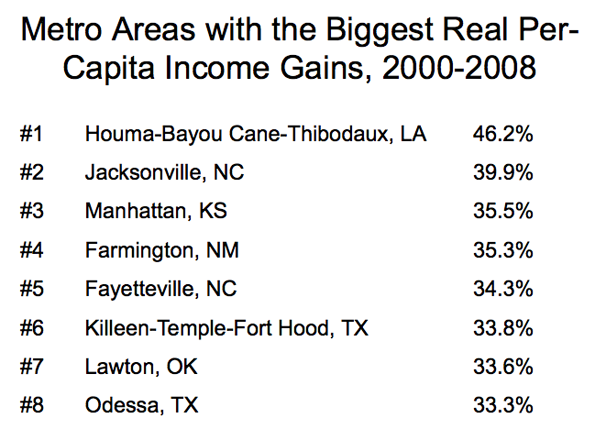

I asked myself these questions when I was preparing for a talk that I was giving at the Rochester Institute of Technology on innovation and economic development. Being a man of numbers, I calculated the gains in real-per capita income for all metro areas. Who do you think was #1, and who do you think was #366 (out of 366)?

A bit surprising, isn’t it? The common themes are guns and oil. The big gains in the #1-ranked Houma region are mainly connected with the increase in oil drilling, since BLS data shows that wages in the mining/oil industry in Terrebonne Parish, where Houma is located, soared from $58K a year to $78K from 2005 to 2008. #2 Jacksonville (NC) is the location of Camp Lejeune. Fayetteville (NC). #5 Fayettville (NC) is home to Fort Bragg, one of the larget military bases in the world. #6 Killeen is obviously home to Fort Hood. #8 Odessa, Texas, is riding the oil boom.

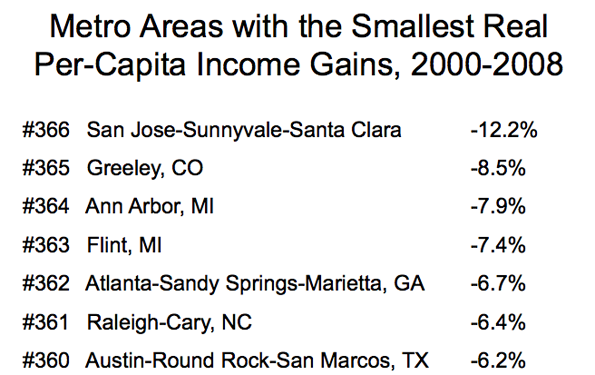

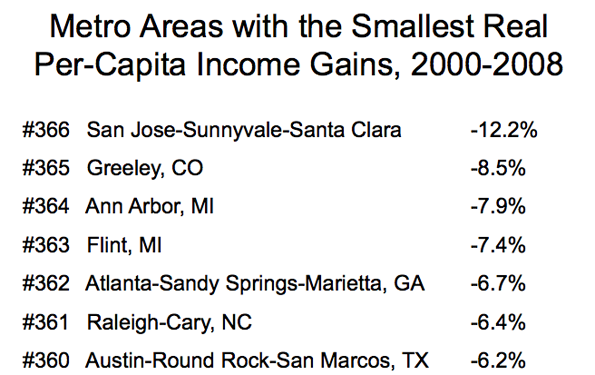

Now let’s look at the metro areas which were the biggest losers in real per-capita income, 2000-2008.

Uh, oh. This is not the list you might have expected, in a world where brains and innovation are supposed to be important. There’s Silicon Valley at the top (or the bottom) of the list, where incomes didn’t recover from the popping of the tech bubble that peaked in 2000. But other tech-type metro areas, such as Raleigh and Austin were hit hard as well.

Brains and education did not seem to count too much in success in the last business cycle. Overall, the top ten cities, measured by growth in per capita income, had an average college graduate rate of 17.7% The bottom ten cities had a college graduate rate of 31.8%.

Is this inverse relationship between growth and education going to persist into the future? Impossible to say. My personal view is that the lack of rewards for education–which show up in the individual income statistics as well–is correlated to the lack of commercially-successful breakthrough innovations, which would immediate sop up all the excess college graduates.

To put it another way, innovative industries tend to locate where they can get a lot of college graduates. That means high education areas attract new companies, boosting growth.

But without innovation, the whole economic development dynamic changes. You can’t attract growing innovative companies because they are few and far between. For their part, companies are more likely to view cost as a main consideration in deciding where to locate. Goodbye San Jose and Austin, hello China and India.

Mike Mandel is Editor-in-Chief of Visible Economy. This post originally appeared on his blog "Mandel on Innovation and Growth."

According to the Bureau of Labor Statistics, there were 290,000 more jobs in the US this month than there were last month. Twenty percent of those jobs were added by the federal government. While the federal government added 69,000 new jobs last month, every other level of government – including the post office – cut an average of 2,250 jobs. State governments were hardest hit last month, cutting 5,000 jobs.

Since April 2009, the federal government has added 119,000 jobs while state and local governments cut 215,000 jobs.

Compared to April 2009, more than 500,000 jobs have been added in employment services. Another 329,000 jobs were added in the healthcare industry. These must be the “green shoots” that we were so looking forward to last summer because the overall economy lost 1,380,000 jobs in the last year.

Eighty percent of the jobs increase last month was added in the private sector. Of the jobs created in the private sector, only 22 percent were in goods producing industries; about half of the goods producing jobs added in the last month can be attributed to the bailout of the auto industry. In the last 12 months, the U.S. civilian population increased by 2.1 million persons. The labor force has remained about constant at 154.7 million. The difference – explained in the details of today’s jobs report – is attributable to discouraged workers, involuntary part-time workers, and marginally attached workers.

|

In 2006, the owner had refinanced the house with a $308,750 loan, indicating a value more than triple that of comparable housing in much of metropolitan America.

In 2006, the owner had refinanced the house with a $308,750 loan, indicating a value more than triple that of comparable housing in much of metropolitan America.